Most fixed-rate repayment-mortgage deals allow borrowers to make overpayments of 10% of the total home loan each year without incurring penalty charges. That means you will have to play catch-up, either through mortgage overpayments later on, or by extending your mortgage term, or by making regular overpayments over time. If you make the temporary switch, the amount you owe on the property loan itself will not change for six months and the interest bill will be higher than it would otherwise have been because the loan is no smaller. Second, there will have to be an alternative repayment plan in place for the borrower to avoid reaching the end of the mortgage term without any ability to repay the outstanding balance. This option does, though, mean that the mortgage balance would no longer be decreasing each month.Īs a result, there are a couple of downsides.įirst, the total interest bill over the life of the mortgage will probably be substantially higher for an interest-only mortgage than a repayment home loan.

If that term were ten years, they would pay £2,651 in capital and interest and £1,041 in interest only. If they switched to an entirely interest-only deal, their monthly costs would fall to £1,041. To give an example, mortgage broker Habito says that someone with a £250,000 mortgage being repaid over 25 years, on a two-year fixed rate of 5%, will pay £1,461 a month. Interest-only is one possible approach for those who want to reduce their monthly mortgage repayments because the higher rates are stretching their budgets to the limit.īy switching you will only pay the interest each month, and therefore your monthly bill will fall. Read more: Six things to do now if you’re fixed-rate mortgage is coming to an end How switching to interest-only affects your mortgage The idea is that households will gain some breathing space to catch up on mounting bills. The difference with the arrangement that was recently announced is that while most lenders already allow you to move to an interest-only mortgage for a short time if you are struggling, the mortgage switch under the government-backed measures won’t be recorded on your credit report or require further affordability checks.

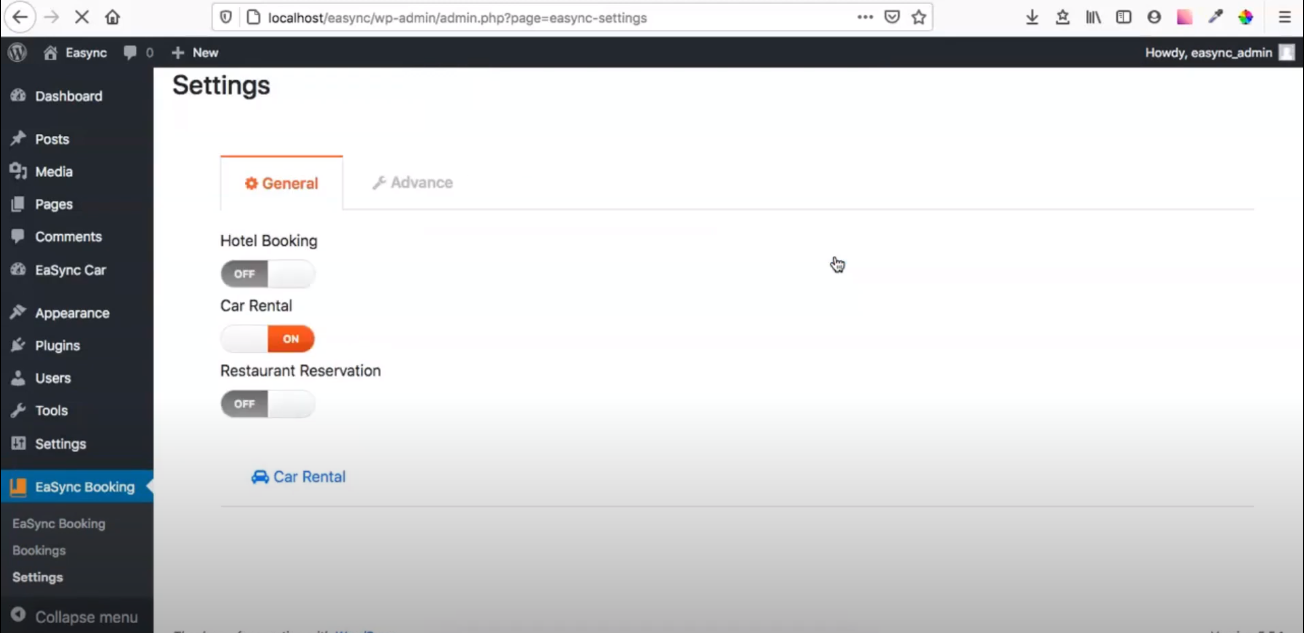

ONE SWITCH RENT A CAR FULL

Your monthly payments will be lower – but at the end of the mortgage term, the full amount you borrowed will need to be repaid in one lump sum.

With a typical interest-only mortgage, you will only pay the interest each month, with the loan amount remaining the same. However, paying interest but not paying off any of the money owed will probably mean higher repayments in the future, so it’s a decision that should not be taken lightly. Under these measures, households who are struggling can switch to interest-only mortgage repayments for up to six months without it affecting their credit score. The government has asked banks and building societies to temporarily relax rules on repayments due to sky-high interest rates. Have you got a cost of living question you’d like answered? Get in touch and I’ll be answering them every Friday: depends. I’m now on a 5% fixed mortgage – should I make the temporary switch? Is it worth it?’ I’ve been hit hard by the cost of living crisis. around midnight.‘I’ve seen that struggling borrowers can now switch to an interest-only mortgage for six months without it affecting their credit score. After a full day of classes, he would do the commute in reverse and get back home to L.A. On a typical day, he would wake up at 3:30 a.m. “My classmates thought I would quit week one, but I treated it as a trip more than a commute,” Bill said. Knowing he would return to Los Angeles after graduation, he wanted to avoid having to pay rent in the Bay Area.īill took commercial flights between LAX and SFO at least three times a week during the academic calendar year for classes. In an interview with KTLA, the user, who wishes to only be identified by his first name, Bill, says all his professors and classmates knew he was a super commuter: “My classmates, instead of asking ‘What’s for dinner?’ they would ask ‘When’s your flight back?'” Bill’s graduation photo taken at SFO, wearing a sash made from all his boarding passes (KTLA)īill says he was living in Los Angeles with a rent he could afford when he got accepted into a one-year master of engineering program at Cal.

In a now-viral Reddit post, user ‘ greateranglia‘ wrote a post titled, “I survived living in LA and commuting to Cal by plane over the past academic year to save on rent, AMA (ask me anything).” ( KTLA) – A Los Angeles graduate student is going viral for how he avoided paying Bay Area rent while attending the University of California, Berkeley.

0 kommentar(er)

0 kommentar(er)